Fundamental Analysis Course

First Learn Than Earn with Fundamental Analysis Courses

Fundamental Analysis Course

Fundamental Analysis Course a two month programme specially designed for all students and professionals that want to focus on the stock market. The basic analysis provides the monetary position of the corporate or monetary depth of the corporate. Underneath monetary analysis, we tend to teach about financial statements, funds statements (cash flow statement or fund flow statement), ratios, P & L statement, balance sheet or etc.

Our Fundamental inspection certification course can assist you to determine to which sector you’ve to enter to take a position by evaluating a security/share or commodity by analysis of the business once identifying the business you’ve to try and do company analysis and identify the company, stock, share, currency or commodity during which you’ve to take a position or trade.

We expert in Fundamental Analysis Courses for Financial Market . Here you will learn about Introduction, Corporate Terms, Company Analysis, Ratios, Money Management & Risk Management, Mind-set of AN investor, Portfolio Management.

Introduction, Fundamental Analysis Courses

- Types of corporations

- Initial public offer (IPO)

- Efficient Market Hypothesis

- Equity-Holding Pattern Analysis

- Concept of “Time value of Money”

Corporate Terms for Stock Market

- Bonus Shares

- Stock Split

- Rights Issue

- Buy backup of Shares

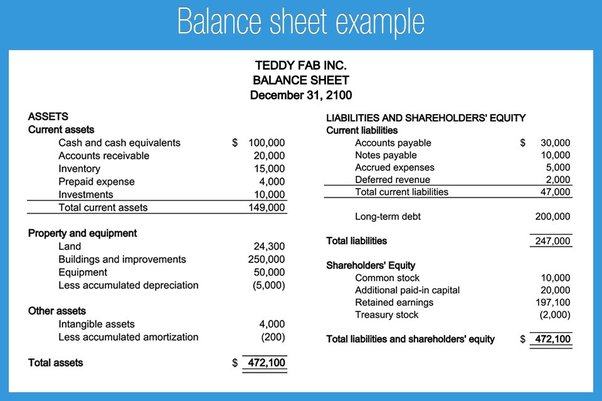

Company Analysis and Balance Sheet

- Balance sheet

- Profit and loss statement

- Direction

- Financial statement

- Channel lines

- Cash flow statement

- Analysis of Quarterly Results

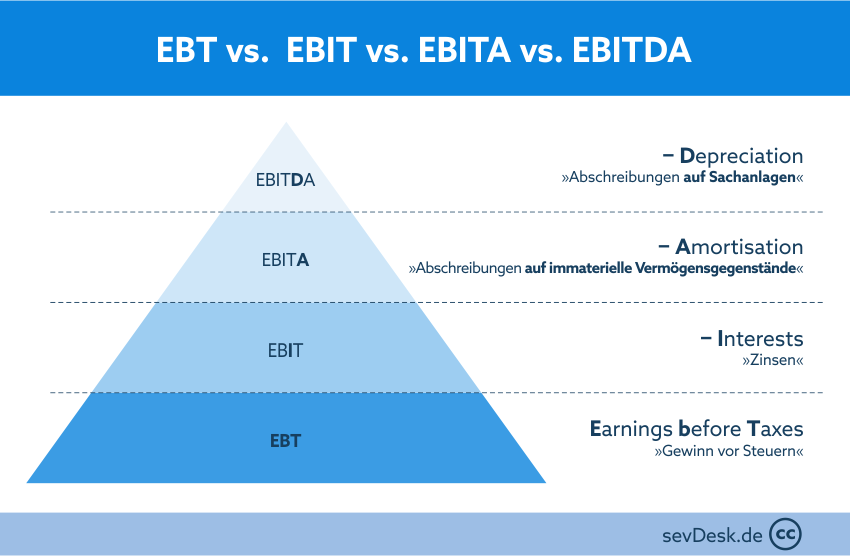

Ratios of EBT vs. EBIT vs. ΕΒΙΤΑ vs. EBITDA

- Price / Earnings quantitative relation

- EBITDA quantitative relation

- PEG ratio

- Profitability Ratios

- Leverage Ratios

- Operating Ratios

- Valuation ratio

- Index Valuation

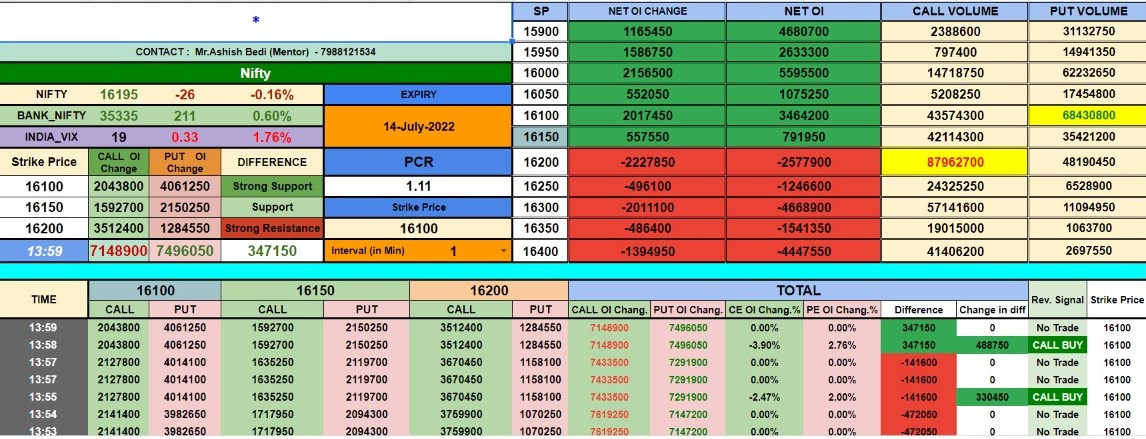

Trader Decision with Stop Loss

- What is stop loss

- How to set Stop loss

- Relationship between rate of interest change &stock price change

- Interest Rate risk on market

Fundamental Analysis Course

Money Management & Risk Management

- Money management set up

- Risk Management set up

- Rules For Discipline trading

Mind-set of AN investor

- Speculator vs trader vs investor

- The compounding effect t

- will investment work?

- Return on Investment and mercantilism

Portfolio Management Analysis

- Stock price vs Business Fundamentals

- Equity analysis

- Systematic Investment planning

- Value investing

- Margin of Safety

- Portfolio Diversification